PETE THORESEN

.

About the Financial Advisor

I believe my job is to make your finances understandable by first learning what’s important to you (understanding), then formulating and implementing a realistic strategy with a plan (not hope), staying in touch in good or bad times to see if your circumstances have changed (service). I believe getting this done will engage you, and then you'll be more confident!

As an Independent Financial Advisor, I believe I can enhance my client’s pursuit of their long-term financial goals with unbiased advice and comprehensive products.

I will do this by acting as your personal Chief Financial Officer (CFO), coordinating my knowledge with that of our firm and with your other council or planning professionals, with the goal of finding a workable strategy for you.

Finally, I will do my best to help you provide for those people you care about most. I will work hard to build a relationship with you based on trust and integrity, always striving to provide you with the same level of ethical service that I would expect from myself.

.

Education and Designations

Institute of Business & Finance, Master of Science, Financial Services

University of Minnesota, Bachelor's Degree, Statistics and Computer Science

CFS® - Certified Fund Specialist

MSFS - Master of Science in Financial Services

Series 7 - General Securities Representative

Series 66 - Uniform Combined State Law Exam

Insurance Producer Life, Accident, and Health

.

EXPERIENCE

2003 to 2023 | Focus Financial | Minneapolis, MN | Financial Advisor

-Investment Advisor Representative with Redhawk Wealth Advisors, Inc.

-Speaker / Educator providing financial educational workshops to employees.

1998 to 2003 | C-Cor / Philips Broadband | Meriden, CT | Vice President Sales

-Managed sales group of about 40 folks | Annual budget accountability + $100m

-Learned the process of identifying long-term goals and solutions for our clients.

.

SERVICES & CLIENT EXPERIENCE

I focus on working with small business owners and individuals for personal financial planning. My services specialize in the following areas:

Personal Planning:

-Retirement and wealth planning: strategies that work for you

-Education funding | How to pay for college

-Investment selection and management: (risk analysis and asset allocation)

-Income tax reduction strategies

-Life, health, disability, and long-term care insurance – navigating these seas

-Estate planning strategies, stock options, restricted stock, and other ancillary matters

-Small Business Planning

Exit | Succession Strategies — retain as much as you can.

-Business Benefit Consulting: Retirement Plans (Profit Sharing, 401Ks), Health Plans (HSA’s, FLEX), Disability, Long Term Care.

-Employee Retention: key employee benefits

.

PERSONAL

Pete enjoys golfing, sailing, skiing, and hiking. Pete and his wife, Jean, have two daughters.

OUR SERVICES

RISK NUMBER

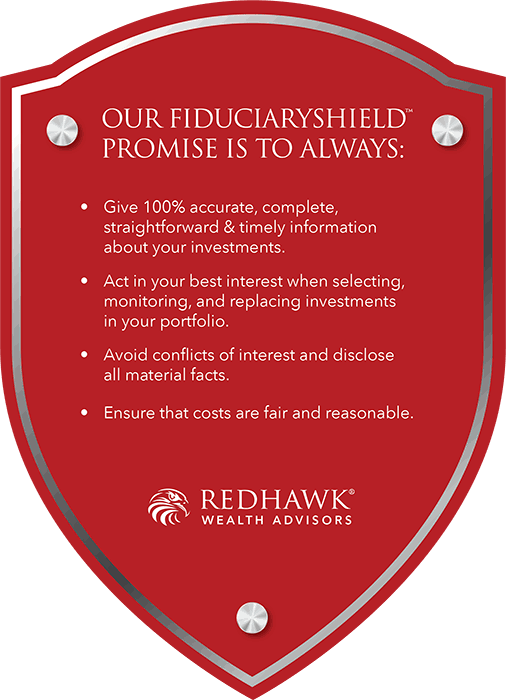

FIDUCIARYSHIELD™